Instant payment: make your payments in seconds!

Today, only 11% of transfers in the Single Euro Payments Area (SEPA) are instant. Still too often offered as a premium service by banks, thereby diminishing its attractiveness, this mode of payment presents multiple advantages for companies.

What are the differences between instant and traditional payments?

Since November 2017, European banks have been able to offer instant payment solutions to their clients. Standard SEPA transfer is available to both consumers and companies. It is sent in 24h, however it may take up to 3 days given that it can only be processed during business days which therefore excludes weekends.

Instant payments, on the other hand, make it possible to send and receive payments 24/7, in only a few seconds. However, the amount sent by instant payment may not exceed €100,000. As opposed to traditional transfers that are free of charge in most European banks, instant payments are not. Many banks are beginning to offer the service at no charge, but most of the time, its price ranges between €0.50 and €1 per transfer.

To accelerate the rollout of instant payments and make them more widely available, the European Commission adopted a legislative proposal on October 26, 2022, which provides for three major developments:

- Obligating all European banks to charge the same price for instant payment transfers as for traditional transfers

- Enabling the verification of the beneficiary’s identity

- Harmonizing the screening process to verify individuals and entities against sanction lists

This proposal still needs to be approved and adopted by the European Parliament in order to enter into force.

What are the benefits of instant payment for your company?

With instant payment, companies are able to avoid late payments and non-payments. If you opt for this means of payment for your invoices, you will receive your clients’ transfers faster and thus cut down on your working capital requirements. This also allows you to:

- Optimize the management of your flows by carrying out your cash treasury transfers instantaneously

- Facilitate the implementation of your treasury plan since you no longer need to anticipate payment or collection dates

- Streamline your treasury management if you operate on a just-in-time basis

- Maintain employee satisfaction by paying salaries and reimbursing expenses using instant payment solutions

Lastly, for e-commerce companies that receive the majority of payments by credit card, choosing instant payment solutions presents even more advantages:

- Lower transaction charges by payment service providers (Visa, Mastercard, PayPal…)

- Better online shopping experience: tedious buyer tasks disappear thanks to pre-filled transfer orders, immediate bank authentication, etc.

- Customer loyalty is enhanced when refunds are made by instant payment

How are instant payments made?

To send or receive instant payments, both parties (payers and beneficiaries) both need this service made available by their banks.

Sending an instant payment is similar to sending a standard SEPA transfer. The following information is required:

- The bank details of the account to be debited

- The bank details of the beneficiaries account: IBAN (mandatory) and BIC code (optional)

- The amount of the transfer

- The transfer date of execution (in the case of instant payment, select immediate)

A word of caution; transfers made by instant payment are irreversible. Ensure that the beneficiary’s bank details are reliable and accurate before validating the payment.

Using payment management software will minimize date entry errors, and will allow you to detect fraudulent bank details.

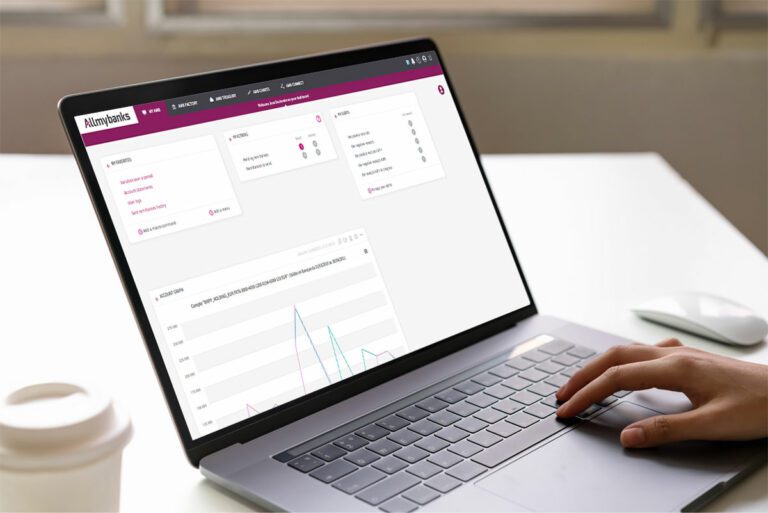

Make your instant payments directly in Cegid Allmybanks