Allmybanks could help you manage your payments and group treasury

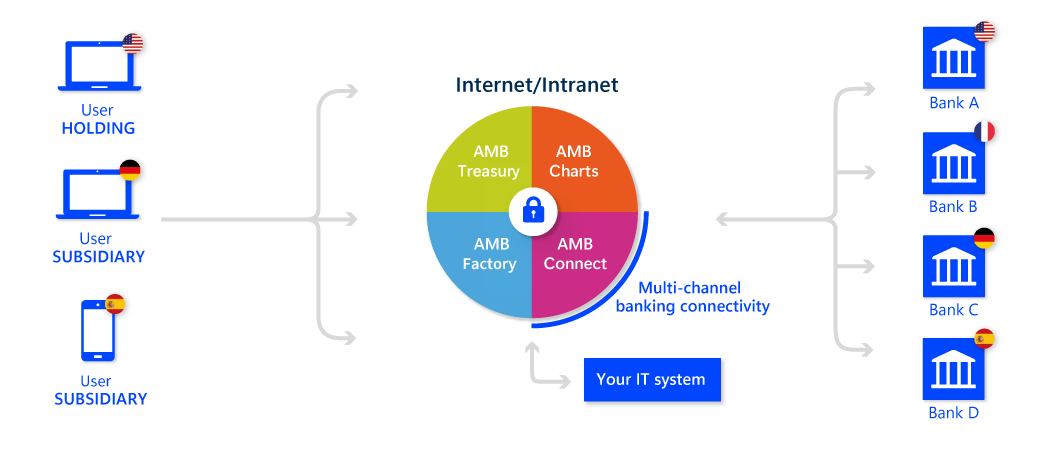

With Cegid Allmybanks, you can secure your financial transactions and optimise your cash flow – all from a single interface. Accessible via a simple web browser (in SaaS mode: Software as a Service), Cegid Allmybanks can be used easily in all your entities around the world.

An access to the SWIFTNet network simplified with Cegid Allmybanks

Cegid Allmybanks is the 1st SWIFT-certified software in France to be connected to the SWIFTNet network via Alliance Lite2 for Business Applications.

You benefit from a Plug & Play solution, quick to implement, and a single point of contact for Cegid Allmybanks software and SWIFT connectivity.

Unlimited number of users

Updates at no extra cost

Autonomy of set-up

Manage your payments and your treasury from a single interface

Receive, view and export your account statements and handle your payments and collections in the AMB Factory module

Manage your operational treasury: forecasts, balancing, intercompany management, risk management, investments and financing using the AMB Treasury module

Depict your principal management indicators in graphs and charts using AMB Charts

Define the rights and signing authorities of your users, as well as your banking communication via the AMB Connect module

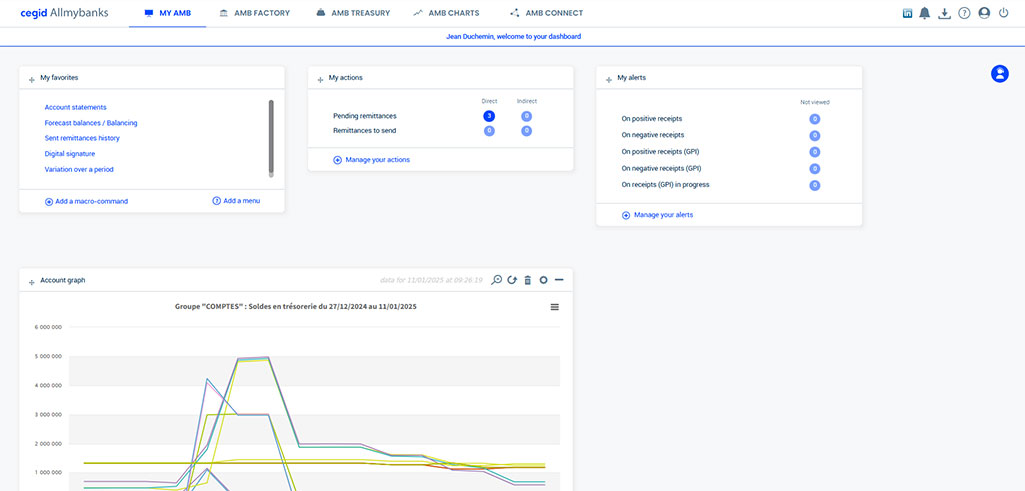

Your customised home screen: My AMB

Get a personalized dashboard on the Cegid Allmybanks homepage

Favorites

Display the menus and macro-commands that you most frequently use

Actions to be taken

Quickly access pending tasks: remittances to be validated or sent, data from your repository to be validated (third-party accounts, users, etc.)

Alerts

Consult your alerts on balances, transactions and receipts

Charts

View graphs of your company’s balances and assets/debts

Ease of access anywhere in the world using the internet

The payment and treasury management software Allmybanks accommodates an unlimited number of companies and users,

and is available in six languages (English, Spanish, French, German, Italian and Chinese). Allmybanks can therefore be used by all of your employees worldwide: an internet connection is all you need to access and use the software.