Payment and treasury management software for corporate groups

Exalog joins Cegid

Cegid confirms acquisition of Exalog, a specialized editor of treasury management software in SaaS mode. Cegid thereby strengthens its offering in treasury, ERP and tax, providing a complete financial suite to meet the needs of Finance departments, from SMEs to key accounts

- Banking communication

- Group treasury

- Reporting and analysis

- Security and anti-fraud tools

- SWIFT and EBICS

Banking communication

Centralise the management of your group's banking flows

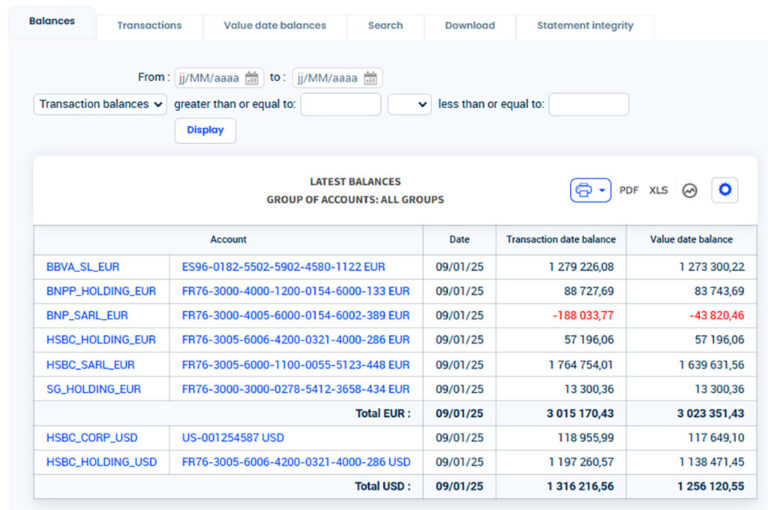

- Account and transaction statements

- Payments and collections

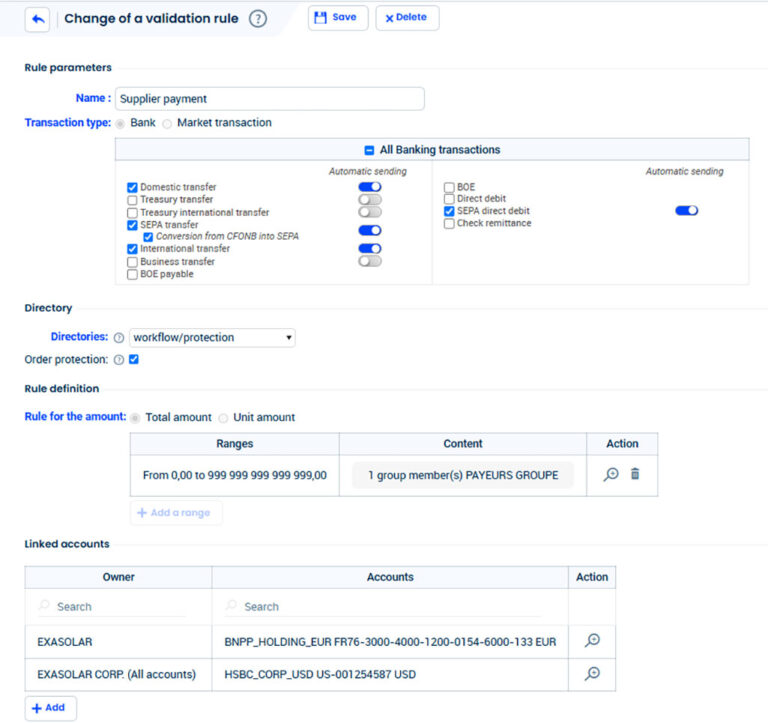

- Validation workflow and digital signature

- Traceability of payments (acknowledgements of receipt PSR, ARA, GPI)

- Central payment factory

- Accounting reconciliation

Group Treasury

Harmonise methods within your group

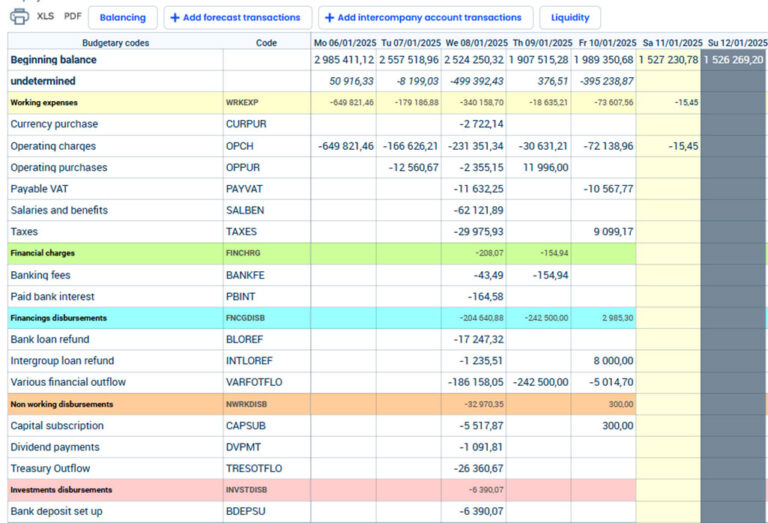

- Operational cash flow

- Cashpooling

- Intercompany management

- Control of bank charges

- Financial instruments

- Foreign exchange risk management

- Treasury Budgets

Reporting and analysis

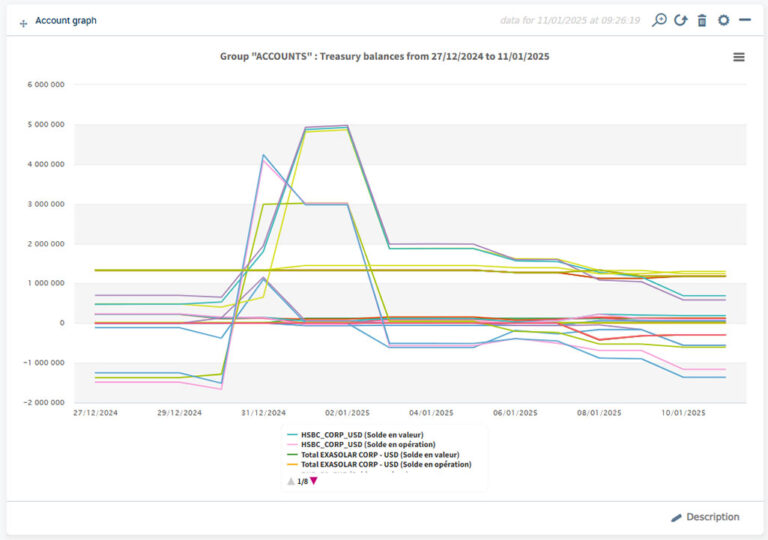

Visualise, analyse and distribute your management indicators thanks to the following functionalities:

- Pre-parameterised reports: variation of balances by budget heading or flow code, net situation of the group, distribution of bank figures as well as agios and commissions, average outstanding balance of bank accounts, situation of loans by holder

- Graphics creation module

- Pivot tables: synthetic and analytical display of your data, customisable models

Security and anti-fraud tools

To secure your payments, Cegid Allmybanks offers you :

SWIFT

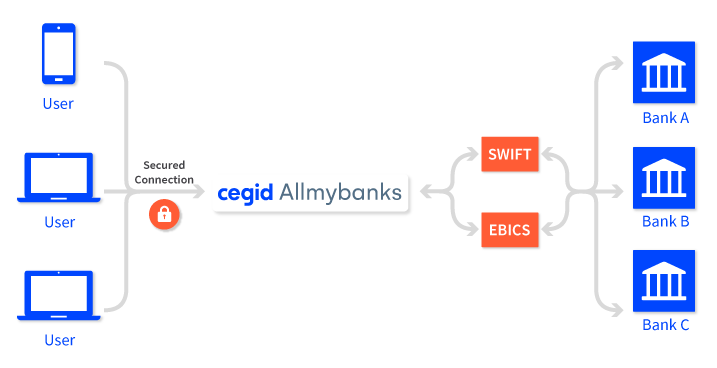

Cegid Allmybanks software is backed by a multi-protocol connectivity platform (SWIFTNet, EBICS, FTP).

The benefits of Cegid Allmybanks

Unlimited number of users

Updates at no extra cost

Free and unlimited assistance

Price transparency

Implementation in autonomy or with support

Scalable and innovative solution

Multi-protocol platform

Payment security

Interfacing with your in-house tools

Our certifications

Cegid Allmybanks certified ISAE 3402, SWIFT, and ISO 27001 for unmatched security and transparency

Cegid Allmybanks stands out for its commitment to security and transparency: ISAE 3402 certification for our rigorous internal controls, adherence to SWIFT’s security standards for unparalleled reliability, and ISO 27001 certification, a testament to our excellence in information security management.

News

Group treasury management: what are the challenges ahead?

Group treasury management, also known as centralized treasury management, refers to cash management within a company with several subsidiaries. This involves planning and centralizing treasury

3SKey, a personal electronic certificate for your payments

For companies making payments with multiple banks, authorization processes can be complex, involving logging on to each bank’s website. With 3SKey, you only need one

Cegid confirms acquisition of Exalog

Press Release Cegid confirms acquisition of Exalog Cegid, a European leader in cloud-based management solutions for professionals in finance (ERP, treasury, tax), human resources (payroll,

There's nothing like a face-to-face discussion to help you understand what's at stake in your and present you with the solution that will meet your expectations.