XLOG's contribution to the development of Cegid Allmybanks in Africa

We welcome Mr. Malick Diagne, CEO of XLOG, a company based in Senegal and partner of Exalog. In this interview, Mr. Diagne explains why he chose Cegid Allmybanks to address the payment and treasury challenges of African companies.

XLOG presentation

Founded in 2016 by a consultant in the management of financial flows and Electronic Banking, XLOG is a digital service company specializing in software integration in banking communication and cash flow management within companies.

XLOG provides analysis services, integration of management software as well as the required training and assistance for the operation and optimization of the solution.

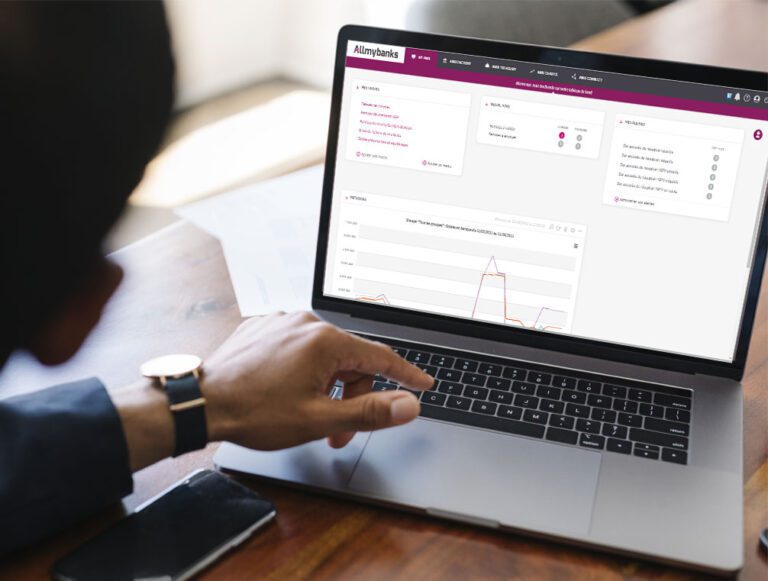

Our activity is based on the distribution of Cegid Allmybanks which is an international payment and group treasury management software that allows users to manage all their company accounts all over the world. We currently have more than 300 users in 6 African countries.

Specific cash management issues faced by Senegalese companies

The challenges encountered by companies in Senegal are:

- The automation of exchanges with banks

- The consolidation of financial information

- The control of the financial activity

In order to receive daily bank statements, banks offer companies to connect to their E-Banking sites in order to download them or to send them by e-mail.

Companies can therefore find themselves managing several communication channels. This lack of automation in the banking data collection leads to constraints related to data security and banking consolidation.

Financial forecasts (short, medium and long term) are an essential link in the control of the banking activity and we note that the financial management rules at the level of certain companies do not allow for the management of all these types of flows.

Why did you choose to recommend Cegid Allmybanks to your clients?

We chose to offer Cegid Allmybanks to our clients because of the simplicity of its deployment: the installation of Allmybanks does not require any additional investment in infrastructure.

The SaaS mode also allows users to connect to the application anywhere and everywhere, which significantly improves productivity.

The SaaS technology, the level of security to access the platform, the policy implemented to ensure data confidentiality and integrity, as well as the availability of the service are determining factors in our choice to recommend and deploy Cegid Allmybanks to our clients.

Clients will benefit from Cegid Allmybanks’ wide range of features as soon as they subscribe to a standard subscription. For instance, subscribing to the treasury offer gives access to the management of the essential financial flows of the company.

What is your clients' feedback on using Cegid Allmybanks?

The mobility provided by the way the Cegid Allmybanks platform is deployed allows our clients to work anytime and anywhere on the software.

Our clients mostly appreciate our availability for their support needs: daily use of the software, management process optimization…

The different modules’ functional evolutions are particularly appreciated by our customers, as well as the ergonomic interface and the clarity of the platform’s functional division.